Guarding Against Risk – Indemnity Insurance Protection

Our reputation for accuracy means that our research results are trusted by the legal sector. As a result, we can offer value for money and speed when it comes to Missing Beneficiary and Missing Will insurance policies. We are authorised by the Financial Conduct Authority for indemnity insurance business under reference number 459862.

With over 45 years’ experience in the field of probate research, we understand that people can sometimes drop out of the historical record when they emigrate to particular regions. We understand that past anxieties about illegitimacy might mean that some entitled relatives are effectively untraceable.

Just as debts can come home to roost after an estate has been distributed, so can long-lost family. After all, no probate genealogist can be 100% sure that all entitled beneficiaries have been identified.

We always give specific advice tailored to the circumstances of each case, so that you and your clients can assess the particular risks involved and compare the costs of all the appropriate options.

Our underwriter requires that all quote requests must be accompanied by a detailed genealogy report, including a verified family tree.

It is important to note that a beneficiary who has been identified but fails to respond to correspondence or phone calls is not considered an insurable risk. Please contact our dedicated team to discuss options for this scenario.

Below we provide a general outline of three insurance products that protect Personal Representatives and other beneficiaries against future claims.

Missing Beneficiary Indemnity Insurance

A Section 27 notice offers personal representatives some legal protection from subsequent claims by an overlooked beneficiary. However, missing beneficiary indemnity insurance extends this so that all beneficiaries are protected. In almost all cases, it is quicker and cheaper than applying to the court for a directions order.

- Known Risk cover (also known as Specific Risk)

Designed for cases where, despite thorough genealogical research, a known beneficiary cannot be located. For example, the deceased’s aunt may have emigrated many years ago, and neither she nor any children she may have had can be traced.

It is important to note that insurance can not be put in place just because an identified entitled beneficiary is unresponsive to attempts to make contact.

- Comfort cover (also known as General risk cover)

Ideal for cases where every entitled beneficiary appears to have been found, but there remains a risk, however small, of untraced illegitimate births or errors in the historical record.

As ever with genealogy, there are times when there simply cannot be 100% certainty that an unknown beneficiary won’t step forward to claim what they are legally entitled to receive. Comfort cover can help mitigate against this scenario.

(Both options can be combined with Missing Will Insurance – see more information below).

Once we have completed our investigation, a competitively priced missing beneficiary indemnity insurance quote can follow fast. A one-off premium, paid from the estate, allows the distribution to proceed to with confidence, knowing that both the Personal Representative and the beneficiaries are protected.

If an overlooked beneficiary does come forward after the estate has been distributed, their claim will be met by the insurance cover in place.

With cover offered in perpetuity, what better way to give total peace of mind for all concerned?

Missing Will Insurance

There is often a worry about whether an intestacy is a genuine intestacy. Is it possible that the deceased left a will, but it hasn’t been found?

When a valid will is found after an estate has been distributed, beneficiaries may be asked to repay the money they have received. To guard against this, we often recommend a specialist search is undertaken to find a lost will. In fact, to obtain a missing will insurance quote, the underwriter must see evidence of an industry-approved will search before any quote can be produced. (We can help you place an insurer-approved Will search if required).

Unfortunately, in the UK there is no mandatory, central will registration. This means that when a search fails to uncover a will, it is often still advisable to take out missing will indemnity insurance. A one-off premium, paid from the estate, ensures that beneficiaries will not have to return their inheritance should a valid will turn up after the estate has been distributed.

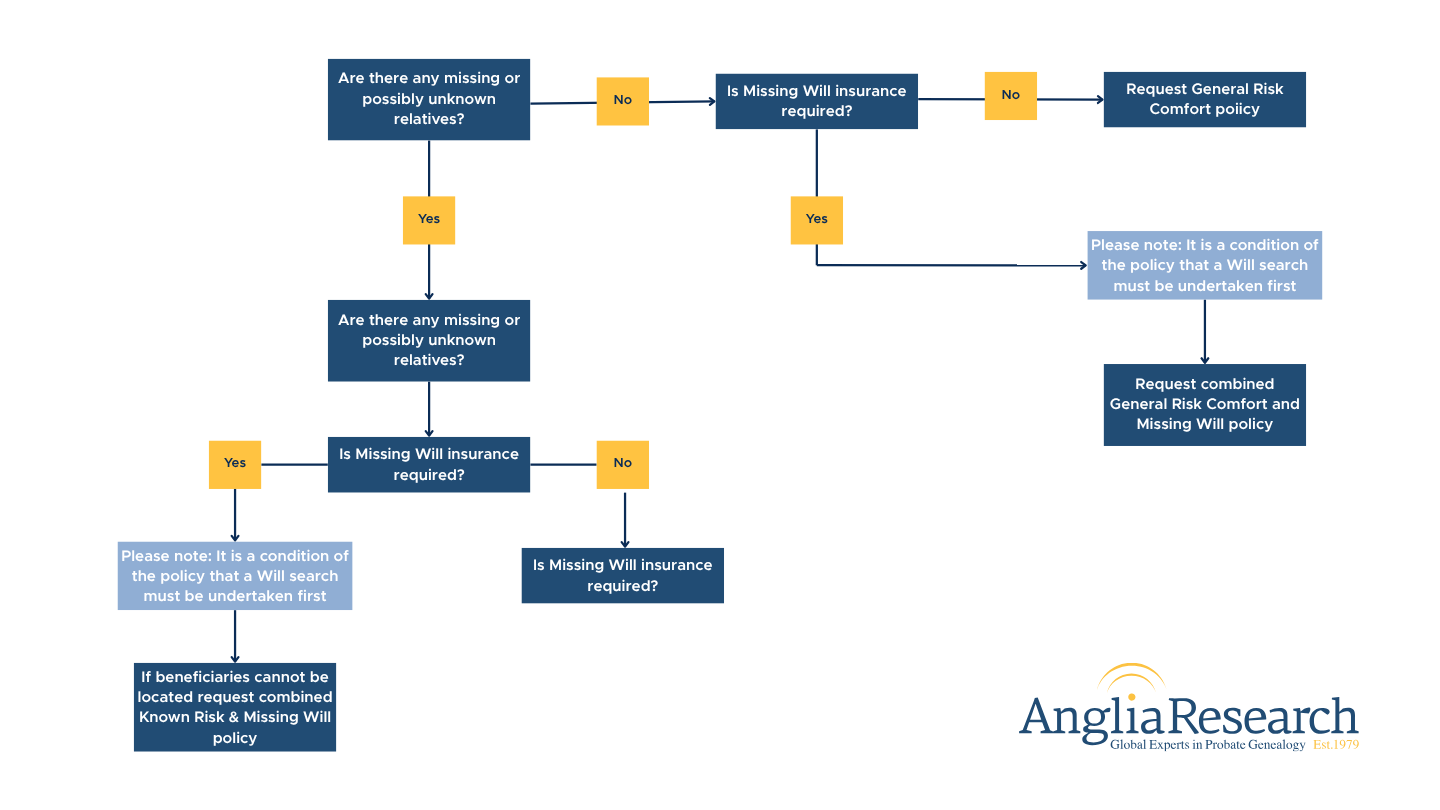

(Flowchart of missing beneficiary indemnity insurance process).

Unknown Creditor Indemnity Insurance (also known as No Section 27 Notice Insurance)

A Section 27 notice offers Personal Representatives some legal protection from subsequent claims by overlooked creditors. However, unknown creditor indemnity insurance extends this so that all beneficiaries are protected.

- This type of insurance is properly known as “No Section 27 Trustee Act (unknown creditor) indemnity insurance”. The estate pays a one-off premium and in the event that an overlooked creditor does come forward after the estate has been distributed, their claim is met by the insurance cover.

What Information Is Required For An Insurance Quote?

The information required to begin the process of obtaining a no-obligation quote is as follows:

- Type of insurance cover required

- Deceased’s full name

- Value of the estate

- Whether a genealogy report is available (please note that we shall need to verify the findings of the report on behalf of our underwriter)

For more specific advice, tailored to your individual circumstance, please contact us.

We can also assist with insurance queries relating to early distribution and unoccupied property.

Anglia Research works with highly skilled legal indemnity underwriters to obtain insurance products tailored to the requirements of each case. Because we are an introducing intermediary, we receive a commission in line with the market norm for this type of business.

Capacity is provided by an “A” Rated global insurer.

Anglia Research is a trading name of Anglia Research Services Limited, a company authorised and regulated by the Financial Conduct Authority for indemnity insurance business under reference number 459862.

What is Missing Beneficiary and Missing Will Insurance?

Missing Beneficiary Insurance protects executors if an unknown heir comes forward after the estate is distributed. Missing Will Insurance protects against a later valid Will being found after administration has begun.

Can I insure against a beneficiary who is unresponsive?

No, this is not something that can be insured against. However, we would be happy to undertake our own search for the missing beneficiary.

What information is needed for a quote?

Type of insurance required, deceased’s full name, value of the estate and whether a genealogy report is available.

Who provides the insurance cover and what is the likely cost?

The policy is underwritten by an A-rated international insurance company, with quotes being tailored to the exact needs of the case.

Are you authorised to offer indemnity insurance products?

Anglia Research Services is authorised and regulated by the Financial Conduct Authority for indemnity insurance business under reference number 459862.

Indemnity Insurance Podcast

Our own Director of Business Development Joe Lander took part in the Today’s Wills and Probate podcast on the topic of Missing Beneficiary and Missing Will insurance with host David Opie. Within the podcast, Joe discusses the options available to practitioners and draws on 20 years of experience in the insurance industry to discuss the “who, what, how, where, and why” of indemnity insurance products in the probate world. You can listen to the podcast below.

Our fees

Our scale and scope of charging is entirely flexible, designed to meet the needs of a client on a case by case basis. We do not seek to tie you into a particular model just to suit our business; we recognise your duty to your client.

Our services

Whether you are looking for the beneficiary of an intestacy, the current owner of a title deed or dormant bank account, or require our expert genealogical research for another reason, we can help.

2025 Anglia Research Services All Rights Reserved.

Anglia Research and Anglia Research Services are trading names of Anglia Research Services Limited, a company registered in England and Wales: no. 05405509

Marketing by Unity Online